Faculty Research Colloquium on ‘Insurance: A Risk Transfer Mechanism’

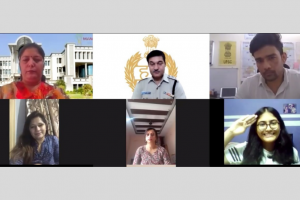

Faculty of Commerce and Business Studies (FCBS) and Faculty of Management Studies, MRIIRS conducted a Faculty Research Colloquium on the topic Insurance: A risk transfer mechanism which was conducted by Ms Ratika Agarwal. Ms Ratika Agarwal, Assistant Professor, FCBS, has done her graduation in Commerce with vocational course of computer applications and Masters in Business Economics with specialization in Banking and Insurance. She has 4 years of industrial experience as a Manager-training in Max New York Insurance Co. Ltd and Edelweiss Tokio Life Insurance Co. Ltd.

The speaker was welcomed by Prof Nand Lal Dhamija. Ms. Swati Watts set the context for the colloquium by introducing the topic. Ms Ratika Agarwal started the discussion by explaining financial planning i.e. the process of meeting one’s life goals through proper management of one’s personal finances. She explained the basic components of financial planning which included investment planning, tax planning, retirement planning insurance planning and risk management. Further, she discussed the risks to human life as well as insurable risks. Risks can be managed in two ways, by risk retention and by risk transfer.

Ms, Ratika said insurance means shifting risks to insurer in consideration of a nominal cost called premium. The components of insurance planning include life insurance, health insurance, insuring physical assets and accident/disability insurance. She concluded the topic by explaining the classification of life insurance plans which are divided into traditional plans and Unit Linked Insurance Plans (ULIPs).

The session was highly interactive. Prof Arya, Mr Sushil Pasricha, Ms Radha Pandit, Dr Preeti Chabhra and Dr Bhavesh put forth some questions which were readily answered by the speaker.

Prof Bedi gave the closing remarks and raised few research issues including the development of an insurance product, Insurance inclination-as risk transfer or as investment and few more.